Inflation rose to 6.2% in February – the highest rate in 30 years and more than 3 times the government-set target.

This month’s inflation data released by the Office for National Statistics (ONS) has revealed that the Consumer Price Index for inflation increased by 6.2% in the 12 months leading up to February. This value is the highest that the inflation rate has been in a long time and has caused quite a stir in Whitehall and the papers. The government-set target for inflation is 2%, with the duty of maintaining inflation at this figure usually given to the UK central bank; the Bank of England. The government sometimes intervenes when inflation gets out of hand, and has been hurriedly pulling together policies to both curb the increase in inflation and to lessen its impacts. There is, however, criticism aplenty from the opposition and from political pundits regarding the government’s handling of inflation.

But what is inflation?

Inflation is a measure of the increase in the price of a good, usually referring to the percentage increase over a 12 month period. For example, if a loaf of bread costs £1.00 and a year later costs £1.05, it has undergone a 5% inflation.

When inflation is reported on it is almost always referring to Consumer Price Index (CPI). The Consumer Price Index, measured by the ONS, is the overall inflation of a ‘basket’ of over 700 commonly bought goods such as bread, bus tickets, a car, and a holiday.

What effects does inflation have?

Positive inflation means the price of goods is increasing, but that doesn’t necessarily mean goods become more expensive. There is another important factor to measure to understand the impact of inflation: wage growth.

If inflation and average wage growth over the same period are the same, then the real wages of the average worker remain unchanged as they retain the same overall purchasing power. If average wage growth exceeds inflation then that means real wages will have increased. If, however, inflation exceeds average wage growth then the real wages of workers will have decreased and their money will not buy as much as it did the year prior.

The cost-of-living crisis currently affecting the UK is an example of the latter case. As of March 2022, ONS figures show CPI inflation to be 6.2% while the average total pay growth is only 4.2%. This translates to a fall in the average worker’s purchasing power of 1.9%.

Why does inflation happen?

Inflation happens for a variety of reasons and is a necessary part of any growing economy. An economy that is not growing is one in crisis, either stagnating with zero or negligible growth, or actively shrinking with negative growth; therefore inflation is something that we must accept as a component of our economic system. Factors resulting in inflation include the following:

- Money supply: In order to facilitate a growing economy, more money must be printed.

- Increased Demand-Supply ratio: If there is an increase in the demand of a commodity without a corresponding increase in supply then the cost will increase.

- Higher Wages: If companies are paying higher wages then they will often increase their prices in order to maintain their profits.

- Devaluation: Currencies are typically traded internationally by being evaluated against a global reserve currency, usually the US Dollar. Countries can intentionally devalue their currency in order to sell export goods more cheaply.

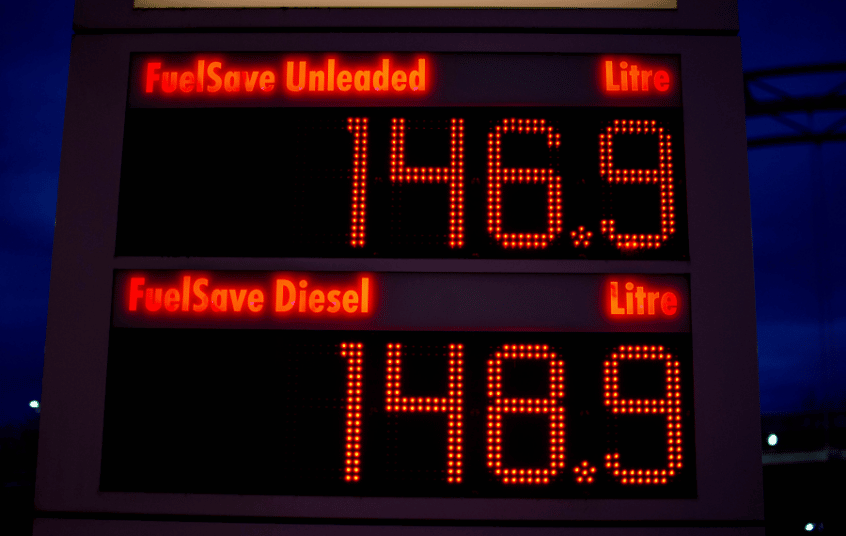

The current high-rate of inflation in the UK is primarily down to an increased demand-supply ratio for oil, gas, coal, and basic food ingredients. Inflation was already very high towards the end of 2021 with the impacts of the covid pandemic resulting in low investment into the energy industry, and the subsequent economic ‘bounce-back’ causing demand to grow far faster than supply. The effects of this were worsened by extended cold periods increasing fuel usage, inclement weather damaging oil and gas infrastructure, and low wind speed increasing fossil fuel demand to compensate for inactive wind turbines.

This situation then became far worse in February when Russia invaded Ukraine. Russia is a major exporter of both oil and natural gas, while both Russia and Ukraine are massive exporters of wheat. The war has resulted in the supply of these commodities decreasing and prices being driven up as a result.

What about deflation?

Deflation is far rarer than inflation and happens when the inflation rate is negative, leading to lower prices. Its causes are largely the opposite of inflation; if massive amounts of money were somehow destroyed, supply outstripped demand, or high unemployment drove down wages, then deflation is more likely to occur.

What can be done to combat high inflation?

- Increasing interest rates, as the Bank of England has done multiple times recently, decreases borrowing and can reduce economic growth and inflation.

- Increasing competition between companies to drive down prices.

- Enacting a higher income tax to reduce spending.

Floating ever upwards?

Inflation is predicted to continue rising, potentially reaching 8% in April when the energy price cap increase comes into effect and making the cost-of-living crisis worse. The Bank of England expects it to take several years for inflation to return to its target figure of 2%.