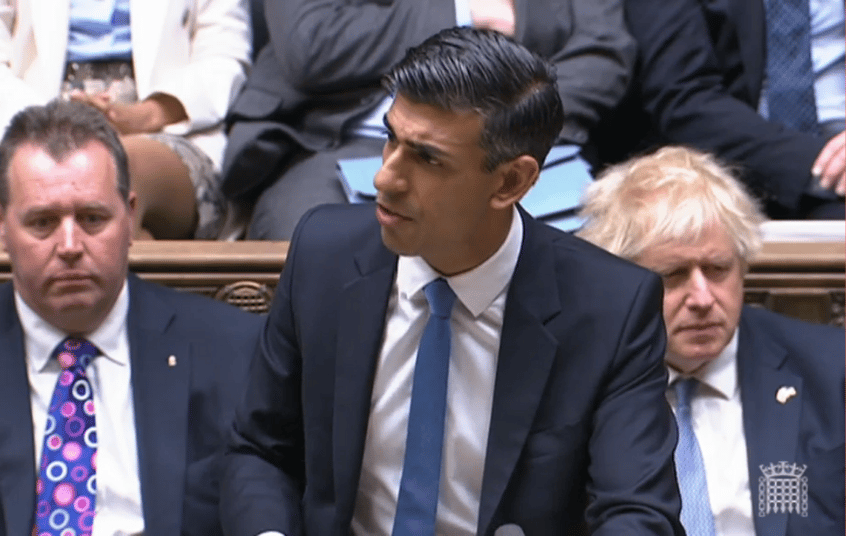

Chancellor of the Exchequer Rishi Sunak has announced a government U-turn on placing a windfall tax “temporary, targeted energy-profits levy” on record-high profits reported by energy companies.

Energy prices started to rise in 2021, after extended cold periods, combined with low wind speed in Europe leaving wind farms inactive, and inclement weather damaging some oil and gas transportation infrastructure and reducing the supply while the demand was growing. The cost rise was further exacerbated in February when Russia, the world’s biggest exporter of natural gas, and second biggest exporter of oil, invaded Ukraine, creating massive fuel uncertainty and driving up prices further. The price increases are the main factor behind the soaring inflation rates strangling the British economy.

While vehicle fuel costs fluctuate constantly, energy prices are capped by the government, being periodically increased every few months. In April of 2022 the government announced a price cap increase of around £700, and in October is expected to announce an increase of a further £800, bringing the average annual energy bill to £2,800; an increase of almost 90% since October 2021. This huge rise in energy bills is expected to bring the number of households in fuel poverty up to 12 million, according to energy regulator, Ofgem.

While the cost-of-living crisis has brought greater attention to economic challenges facing the country, there are some longer-term indicators of economic degeneration which have been slowly worsening for around a decade; foodbank use has increased almost 100 fold since 2008, while real wages have remained stagnant over the same period, despite the Prime Minister’s insistence that the Conservatives have produced a “strong and robust” economy.

In April the government announced, alongside the energy cap increase, that it planned to issue families a £200 energy discount alongside a £150 council tax rebate. The £200 discount plan received criticism from opposition parties as it was required to be repaid in £40 instalments over 5 years.

The government’s plan was condemned by opposition as not going far enough. Labour’s counterproposal was an extension to the warm homes discount scheme, alongside a windfall tax on energy companies’ profits.

A windfall tax is a one-off tax levied on a business that reports unexpectedly high profits. Energy companies have been raking in unprecedented profits over the first quarter of 2022 in the wake of fuel cost increases, with Shell reporting a profit of over $9 billion, and BP a profit of over $6 billion, for the first quarter of 2022, more than double their respective profits from the first quarter of 2021. BP’s finance boss said the company has “more cash than we know what to do with”, describing the firm as a “cash machine”.

The Conservatives have repeatedly opposed a windfall tax, arguing that it will discourage companies from investing in the UK in fear of sudden and unexpected taxes on profits. It is, however, believed that a windfall tax in this particular case is unlikely to affect investment negatively, with BP CEO Bernard Looney saying that no planned investment in the UK would be cancelled in the event of a windfall tax, although the company had intended to use the money to buy back shares and “reward” shareholders with increased dividends.

Over the last couple of weeks, with record inflation being reported and Ofgem predicting an £800 fuel rise in the energy price cap opposition parties have united in calling for a windfall tax, while the government has remained ostensibly opposed its messaging has been increasingly confused over the past month. On the 27th of April Dominic Raab called the idea of a windfall tax “disastrous”, while on the evening of the same day Chancellor Rishi Sunak said a windfall tax is “something I would look at and nothing is ever off the table in these things.” On the 12th of May Johnson openly opposed the idea once again, saying “I don’t think they’re the right thing. I don’t think they’re the right way forward. I want those companies to make big, big investments.”

At last week’s PMQs, Labour leader Keir Starmer said of the Prime Minister’s position on the proposed windfall tax.

“Doesn’t he see that every single day he delays his inevitable U-turn – he is going to do it – he’s choosing to let people struggle when they don’t need to.”

Now, a week later, Rishi Sunak has announced that the government is indeed swapping its stance on the policy, although he was too coyly avoided referring to his plan as a windfall tax. The Chancellor announced in parliament that the government intends to levy a 25% windfall tax on energy companies until energy prices return to normal levels, with companies able to reduce the amount they are taxed for the more they invest in the UK.

He announced the following plans to ease the cost-of-living crisis, to be partially funded by the windfall tax, and which are undeniably much more generous than the plans he had previously announced in April.

- 8 million of the UK’s lowest-income households will receive a one-off payment of £650.

- The £200 repayable discount has been increased to £400 and will no longer need to be repaid.

- 8 million pensioner households will receive an additional £300 as part of their winter fuel payment.

- A one-off payment to disabled people worth £150.

The newly announced support will cost a total of £15 billion, according to the Chancellor, while the windfall tax is expected to raise £5 billion.

Labour politicians have welcomed the announcement, but have criticised the Chancellor and government for taking so long to get on board with ideas that they say they have supported from the start.

Shadow Chancellor Rachel Reeves said:

“Let there be no doubt about who is winning the battle of ideas in Britain, it is the Labour party,”

“Today it feels like the chancellor has finally realised the problems the country is facing.”

“[the Chancellor’s] dither and delay has cost our country dearly.”

She also accused the government of only making the announcement to draw attention away from Partygate and the newly released Sue Gray report:

“Labour called for a windfall tax because it is the right thing to do, the Conservatives are doing it because they needed a new headline”

Meanwhile, Keir Starmer tweeted:

https://twitter.com/Keir_Starmer/status/1529722083059572737?ref_src=twsrc%5Etfw”>May

However some feel that even now the government has failed to do enough, with the SNP’s Kirsty Blackman disappointed that the government has no plans to increase benefits inline with inflation, and the Lib Dem’ Christine Jardine sayning it is “too little, too late” and should have been done back in October when it “could have made a difference”.